The master of finance versus MBA: how do they stack up in comparison to one another? That is an important consideration because graduate degrees are expensive investments. How do students decide which degree is the right one for their career? To answer that question, it is necessary to look at both degrees and at what they offer students. Choosing which of these programs best suits them can be challenging for students because both programs offer intensive study and high-paying career opportunities in the future. Both degrees can prepare students to handle positions at the administrative level in both the business and finance industries. The major difference between these programs is that the MBA equips students with broader skills and knowledge in business and helps graduates apply these skills in many different areas. On the other hand, master of finance programs are more finance-specific. The individual’s career goals should determine which program they ultimately choose.

The master of finance versus MBA: how do they stack up in comparison to one another? That is an important consideration because graduate degrees are expensive investments. How do students decide which degree is the right one for their career? To answer that question, it is necessary to look at both degrees and at what they offer students. Choosing which of these programs best suits them can be challenging for students because both programs offer intensive study and high-paying career opportunities in the future. Both degrees can prepare students to handle positions at the administrative level in both the business and finance industries. The major difference between these programs is that the MBA equips students with broader skills and knowledge in business and helps graduates apply these skills in many different areas. On the other hand, master of finance programs are more finance-specific. The individual’s career goals should determine which program they ultimately choose.

MBA

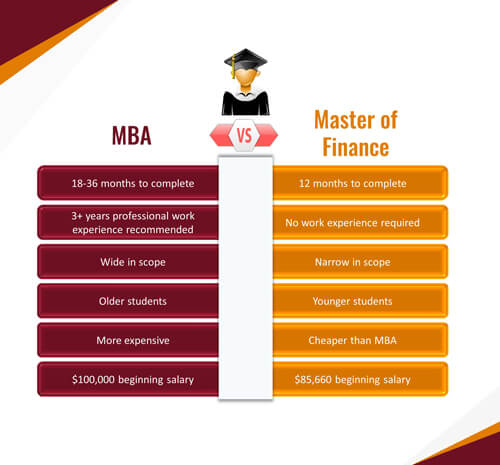

MBA–the acronym stands for Master of Business Administration. This is a degree that may take 18 months to three years to earn, depending upon whether it is a part-time or full-time MBA program. The scope of an MBA program is broader than that of a finance master program, allowing for general knowledge of business and specializations in several fields. MBA applicants should have at least three years of work experience in a related field. They also have to complete an undergraduate degree from an accredited school. Subjects addressed in an MBA are accounting, statistics, economics, communications, management, entrepreneurship, and other subjects, including those that lead to the specializations. Some of the more popular specializations are agribusiness, energy, healthcare management, cybersecurity management, human resources, and, of course, finance. However, you can earn an MBA in unusual areas such as aviation, aeronautics, film and television producing, luxury management, infrastructure, wine marketing and management, and many more. In the U.K., students can even earn a Thoroughbred Horseracing Industries MBA (University of Liverpool). Top ranking schools in the USA that offer MBA programs are the University of Pennsylvania, Northwestern University, and Stanford University.

Master of Finance

Business master’s degrees are among the most popular master of science programs. The master of finance is a popular offering among those programs. It is narrower in scope than the MBA. Students in this degree path study financial theory, mathematics, quantitative finance, investments, markets, financial reporting and analysis, and valuation. These subjects are addressed in the MBA as well, but the MF degree program covers them in detail. Since MBA students typically need work experience before being accepted into a program, and because MBA programs are usually more expensive than master of finance programs, most master of finance students are younger than MBA students. The master of finance is more appealing to students who want to jump-start their careers in a relatively short period of time.

Length of Program

An MBA can take up to three years to earn. There are two basic types of MBA programs, according to Investopedia. The first is a full-time MBA that can be earned in about eighteen months to three years. People who choose this type of program are generally students who have just earned their bachelor’s degrees and just continue their studies. The second type of program is the part-time MBA., Part-time MBA programs come in two options as well. The EMBA, or Executive MBA is for people who have worked in business for some time, generally as executives or in management. Students in this type of program average 38 years of age, and they are often supported in their goals by an employer. The regular part-time MBA is intended for students who work in a business position in a non-managerial capacity and want to further their careers. These programs are offered in the evenings, on weekends, and online. The master of finance student is usually younger and has no work experience. This degree can be earned in one year, sometimes as a continuation of undergraduate study or in an accelerated program.

Program Cost

Though MBA programs are not cheap, the cost of your program depends upon where you earn the degree. There are some extremely prestigious business schools out there, schools that look impressive on a resume. Degrees from these schools can come with a hefty price tag. Allowing for a tuition of $80,000 and another $20,000 in room and board, plus additional costs for supplies, computers, internet, and fees, a degree from a private business school can easily amount to $200,000. The average tuition at a public school, according to an article in the US News and World Report, is $43,600 per year. Students also must consider the amount of income available to them while they study. Those who pursue a full-time degree may have up to three years of expense with no income. That makes financial aid crucial. Students in an EMBA program may be sponsored by their employers. Other part-time students studying on weekends or evenings or online may continue to work while they earn their degrees. Obviously, the shorter the duration of the program, the less expensive it becomes.

Best Investment

So, which is the better investment? The answer to that question depends upon what your career goals are, but it may also depend upon other factors like the economy and supply-and-demand. Forbes says that the number of applications for MBA programs is declining. Some private business schools find their enrollment in these programs cut by as much as 50 percent. The general demand for students with graduate business degrees, however, has grown dramatically. Full-time MBA graduates earn salaries that are 50 percent higher than the salaries they earned in the year before they began business school. Within five years, their salaries, on average, double. Even though the number of people applying to MBA programs is declining, the MBA is still the “gold standard” in business degrees. While the number of applications for MBA programs is declining, the number of people earning MS degrees is rising. MS degrees like the master of finance take only a year to complete so they cost less. That makes them popular with younger students with a specific career in mind. For those who may want to change careers within the business realm, the MBA may offer a better return on the investment because the wider scope of knowledge will make the transition easier. People with graduate degrees earn about $17,000 more a year than those with undergraduate degrees. Plus, while the MBA is a hefty investment, it is generally paid off, including salary lost while studying, in three-and-a-half years according to Forbes.

Comparative Salaries

People with an MBA degree can generally earn $100,000 a year. After ten years, top workers can earn as much as $300,000. Because they usually lack the work experience MBA graduates do, and the depth of knowledge, people who have a master of finance can expect to earn less than those with an MBA. The Bureau of Labor Statistics gives a beginning salary for these professionals as $85,660. Any advanced degree will make a big difference in the salary professionals earn, though those with an MBA earn more. There is another consideration involved in the choice, however. People who want the breadth and depth of the MBA program and who genuinely enjoy learning may derive more personal satisfaction in completing the longer program. Those with a more practical outlook may be interested in the shortest path to the goal. Deciding which program is the right program is important because you are investing time and a considerable amount of capital in the degree. Many variables are involved in the study of the master of finance versus MBA.

Master of Finance versus MBA Career Options and Job Placement

Master of Finance vs. MBA issues have created confusion among individuals who want to pursue either of these graduate programs. Master of Finance students prepare for careers in trading and principal investments by taking courses like capital markets, economics, investment management, and financial strategy. Meanwhile, the broad coverage in MBA programs prepares students to work in different fields and hold positions as financial managers and controllers. Those who want an MBA career may work in commercial banks and deal with things like trusts, mortgages, lending, and investments. MBAs can also assume responsibilities like managing large financial institutions and administering individual branch office functions. Governments and non-profits also hire graduates from the best MBA degrees to help them run the organization effectively. Meanwhile, large companies have also realized the need to have graduates with the best master of finance degrees. This is especially true for firms that solely offer finance-related products and services. With the increasing number of people entering these programs, the competition is getting tougher. Graduates from both programs often seek jobs at financial firms. Since both the master of finance and the MBA are excellent choices for furthering one’s education, choosing a Master of Finance versus MBA should depend on the student’s capacity and career goals.

Common Job Titles Obtained by Master of Finance Graduates After Graduation

- Associate; A couple of possible variations on this title include investor relations associate or research associate

- Accountant or Certified Public Accountant (CPA)

- Investment banker

- Financial analyst; there are also countless possible variations on this title such as junior financial analyst, senior financial analyst, public finance analyst, financial planning analyst, research financial analyst, financial reporting analyst, hiring financial analyst, pricing analyst, financial data analyst or quantitative financial analyst.

- Finance officer

- Budget analyst

- Actuary

- Credit analyst

- Chief Financial Officer (CFO)

- Financial Director

- Controller

- Financial examiner

- Portfolio manager

- Trader

- Stockbroker

- Personal financial advisor

- Loss mitigation specialist or loss mitigation supervisor

- Mortgage loan officer

- Banking operations manager

Common Job Titles Obtained by MBA Graduates After Graduation

- Accountant or Certified Public Accountant (CPA)

- Accounting manager

- Financial analyst

- Finance officer

- Consultant; endless variations on this title exist. Some examples include consulting manager, investment consultant, finance consultant, management consultant, Medicare consulting specialist, inclusion and diversity consultant or energy consulting specialist.

- Associate

- Project manager

- Investment banker

- Marketing manager or variations such as digital marketing manager or social media manager

- Director of user experience

- Marketing director

- Brand manager

- Business development representative

- Portfolio manager

- Human resources manager

- Business operations manager

- Logistics manager

- Sales manager

- Product manager

- Chief Executive Officer (CEO)

As you can see, there’s a great deal of overlap between the job titles that Master of Finance vs. MBA graduates can successfully compete for.

Reasons You Might Want to Choose a Master of Finance vs. MBA

- Your career goals are strictly focused on investment banking, accounting or a related finance industry niche. You’re absolutely certain that finance is the industry you want to work in; you don’t anticipate wanting to change careers in the future to do marketing, human resources management or other such activities outside of the financial sector.

- You haven’t yet obtained any work experience.

- You don’t want to invest more than one year pursuing an advanced degree.

Reasons You Might Want to Choose an MBA Over a Master of Finance

- You don’t want to strictly limit yourself to pursuing a career in finance; You’d also like to have the option of pursuing a career in management or marketing.

- You’ve already gained some work experience.

- You’re willing to invest at least a couple of years in furthering your education.

- You’re hoping for long-term job prospects that are relatively resistant to automation.

The Future Employment Outlook for Master of Finance Versus MBA Graduates

There are too many variables preventing anyone from predicting with ultimate certainty what the future job outlook will be for any degree program. The best you can do is study the available data and make educated guesses about what outcome looks likeliest. Analyzing the available data regarding the likeliest future employment outlook for Master of Finance versus MBA degrees, both degrees appear to offer favorable job prospects in the short term.

In the long term, the available data seems to indicate that future prospects for MBA graduates may be more favorable than prospects for graduates holding Master of Finance degrees. This is because it will be relatively easy for companies to automate many of the tasks done by finance industry professionals. Experts anticipate that automation technologies are likely to reduce the numbers of available jobs in the finance sector. In contrast, it is much more challenging to automate management jobs.

According to McKinsey, the finance sector has been one of the foremost leaders in the adoption of automation technologies. In contrast, management activities are some of the least susceptible to automation.

Analysts at the US Bureau of Labor Statistics do not typically post predictions about the job prospects for graduates of various degree programs, but they do post forecasts for the future outlook of individual job descriptions. Therefore you can make an educated guess about what the future job market for MoF or MBA degrees might be like by studying a few of the BLS projections for typical jobs held by these graduates. Let’s take a look at a few examples:

Managers

Analysts at the BLS are predicting a combined nine percent in growth in demand for managers in the United States by the year 2030. This amount of job growth, if realized as expected, would about keep pace with the rate of growth exhibited by the US economy as a whole.

Accountants and Auditors

BLS projections indicate that there is likely to be about a seven percent increase in demand for accountants and auditors by the year 2030. In the future beyond that, expert consensus seems to indicate that there is likely to be a significant decline in demand for accounts receivable and payable accountants.

Financial Analysts

BLS analysts are predicting six percent growth in demand for financial analysts by the year 2030.

Financial Services Sales Agents

BLS analysts are predicting slower-than-average future growth in demand for securities, commodities and financial services sales agents. They do anticipate that there will continue to be demand for investment banking services, but they caution prospective employees to be aware that demand for human employees in this sector is slowing. They point out that automated trading systems have led to a decrease in demand for securities traders.

Related Rankings: